freelance income tax malaysia

Moreover you could enjoy better tax rates for sole proprietors claim for business expenses and deductions. Hiring Tax Preparation Freelancers in Malaysia is quite affordable as compared to a full-time employee and you can save upto 50 in business.

How To Calculate Income Tax In Excel

Get in Touch 44 0 208 935 5339.

. Negotiating the terms of business deals and moves with clients and associated organisations. If the sum is less than 600 the person or organization that paid you isnt required to send a 1099. On the bright side you only need to pay taxes on your chargeable income which is your total annual income minus all the tax reliefs and exemptions that Malaysian residents are eligible for.

You can easily search for the forms here on the LHDN portal. It will calculate Malaysian Income Tax and wage taxes. Find Corporate Income Tax Experts in Malaysia that are available for hire for your job.

Malaysia Tax Preparation Freelancers are highly skilled and talented. When you exceed RM38k per year youre required to file your income tax. So I made one.

Are all earnings considered taxable and what tax form should freelancers use. Financial forecasting and risk analysis. Advise on the best and latest possible incentivetax deduction available for the tax payer.

Dealing with insolvency cases. Find Personal Income Tax Professionalsa in Malaysia that are available for hire for your job. Outsource your Personal Income Tax jobs to a Freelancer and save.

So yes if you are a freelancer you are subject to income tax and therefore must file your income tax. The tax deducted requires submission to IRB within a month of payment to non-resident freelancers. Up to RM3000 for kindergarten and daycare fees.

The due percentage will depend on the services rendered. Providing tax planning services with reference to current legislation. Ive divided the article into 5 sections.

Meeting and interviewing clients. Outsource your Corporate Income Tax jobs to a Freelancer and save. However you still must report that income to the IRS.

Outsource your Corporate Income Tax jobs to a Freelancer and save. We will put the content up when we receive enough interest. You can still avail the minimum exemption of Rs 250000 on your total income.

Income from overseas relating to services performed in Malaysia is taxable. So if youve been entering local earnings under the salary head your foreign income too would need to be entered under this head. If youre a tax resident in your tax return it would indicate that you have no tax to pay.

If you are a non-resident individual freelancing in Malaysia note that a withholding tax of 3 to 25 will be applicable on each payment to you by the client. Instead of the EA form self-employed individuals will have to fill in the BE form. Correspondence with IRB in the event of tax appeals disputes and reassessments.

RM9000 for individuals. And perhaps even demonstrate greater credibility to your clients. 18A 20 20A Jalan Sasa 2 Taman Gaya 81800 Ulu Tiram Johor Malaysia.

How much can you make as a freelance writer in Malaysia including how to set your. If youd like a copy of it please contact us. Here are quick tips to make filing for income tax as a freelancer easier.

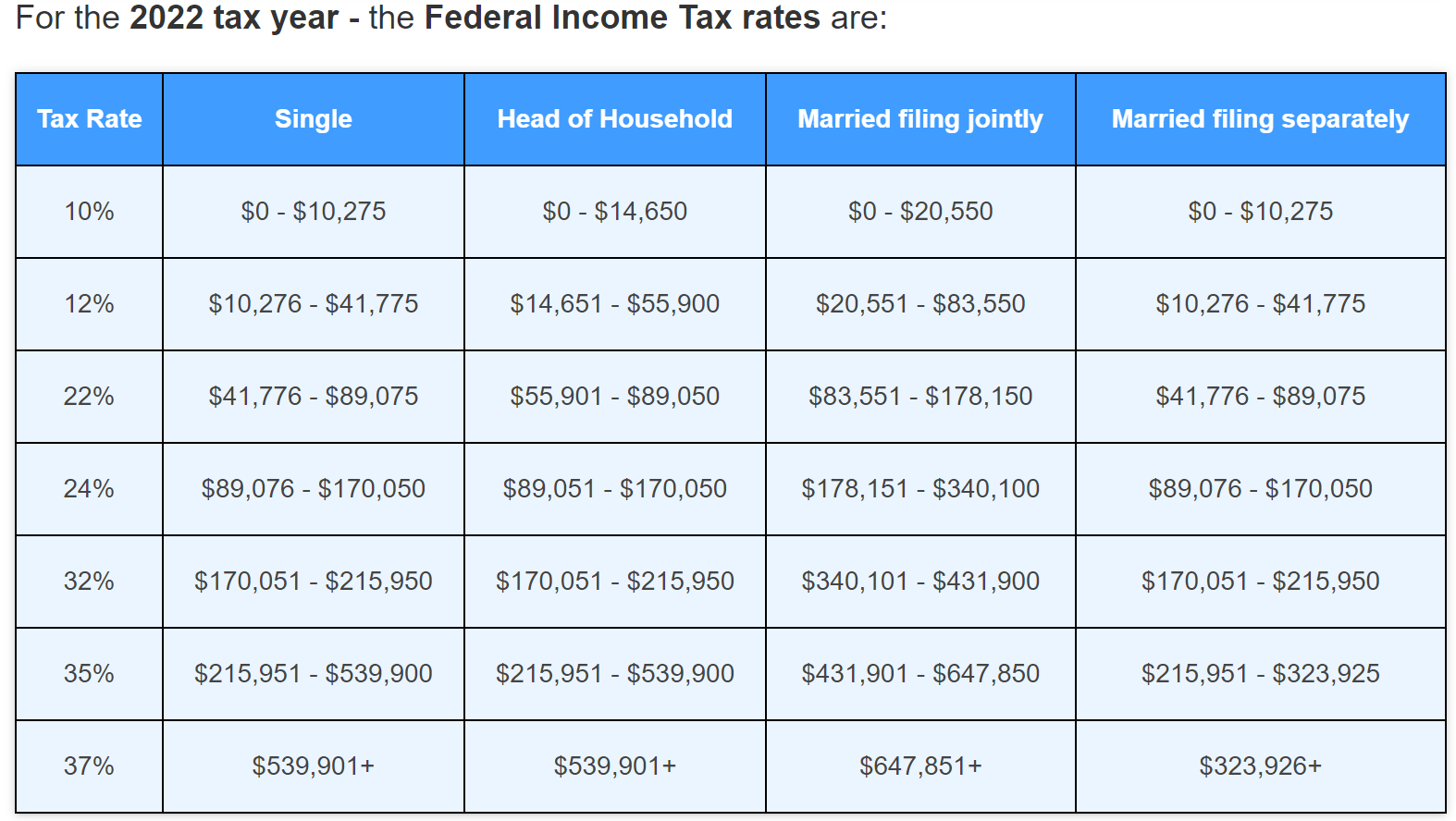

Its tricky to get a loan as a freelancer but your chances are definitely improved when you have a viable legitimate business to show. You can also submit through e-Filing here. Income tax in Malaysia can range from 0 to 28 percent and you need to be sure you are placed in the correct tax brackets.

This is a placeholder for the tax calculator for Malaysia. How is filing for income tax as a freelancer different to a regular employee. Double Tax Agreement DTA.

Send it our way. If you are a contractor and want a calculation on your tax and net retention in Malaysia we can supply it to you free of charge. Take advantage of all the eligible tax reliefs.

Your foreign income will need to be treated in the same way as your local income. Externalisez vos travaux Personal Income Tax à un freelance et faites des économies. If youre a freelancer who has registered your work as a business however youll fill in the B form.

Find Corporate Income Tax Experts in Malaysia that are available for hire for your job. Uniform laws for foreign and domestic income. Sales tax fully waived for new passenger vehicles.

When you earn freelance income youll receive whats known as a 1099-MISC form from anyone who paid you more than 600 during each tax year. When your income is more than RM42k you would start paying income tax. You dont have to pay taxes in Malaysia if you have been employed in the country for less than 60 days or for income that is earned from outside of Malaysia aka foreign-sourced income.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Trouvez un Personal Income Tax Professionalsa à Malaysia qui est disponible pour votre travail. Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers.

Hire a tax consultant. Fill in your forms. Freelancers and part-timers too are required to register and file their taxes.

If you are a freelance writer in Malaysia either doing it as full-time work or as a side income here are some finance-related information about incomes and expenses that you should know about.

How To Sell Online Payslips To Your Employees Payroll Payroll Template Things To Sell

How To Calculate Income Tax In Excel

Malaysia Payroll And Tax Activpayroll

How To Calculate Income Tax In Excel

Freelancer Received Their First Payslips To Aid In Pay Transparency In The Uk About Uk Paying National Insurance Number

How To Calculate Income Tax In Excel

How To Prepare Income Tax Return Infotax Group

What Is The Income Tax Rate For Salaried Professionals In Singapore Quora

Ecosia S Financial Reports And Tree Planting Receipts Trees To Plant Financial Investing

How To Calculate Income Tax In Excel

Thoughts On Virtual Crypto Currency Taxation In The Us Advanced American Tax

New 2022 Foreigner Income Tax Changes To Expense Deductions Fdi China

How To Calculate Income Tax In Excel

Taxes For Bloggers How To File Taxes On Your Blogging Income 2022

Comments

Post a Comment